The Virgin Atlantic Reward Credit Card offers a structured path to earn Virgin Points, unlock cashback, and secure flight-related perks without paying an annual fee.

Follow this guide to decide whether the card belongs in your United Kingdom wallet and to learn the exact steps for applying confidently.

Virgin Atlantic and the Flying Club Program

Grasping the airline’s loyalty scheme helps you judge the card’s long-term worth quickly. Virgin Atlantic’s Flying Club awards Virgin Points that never expire, allowing you to build your balance at a pace that suits your lifestyle.

This flexibility makes the program especially attractive for both frequent and occasional travelers. Virgin Points can be redeemed across all cabin classes—from Economy to Upper Class—on Virgin Atlantic flights, though taxes and surcharges still apply.

The program also extends to partner airlines, hotel stays, car rentals, and upgrades, offering broad utility on global journeys. With saver reward seats starting at just 6,000 points one-way, even light spenders can enjoy real-world travel benefits.

Core Spending Rates and Everyday Value

Brief rate tables often hide the real payoff. This overview translates numbers into practical benefits so you know exactly what every swipe yields.

| Purchase Type | Points per £1 Spent | Typical Use Case |

| Everyday card purchases | 0.75 points | Groceries, online subscriptions, household bills |

| Virgin Atlantic or Virgin Holidays bookings | 1.5 points | Flights, package holidays, ancillary fees |

A monthly points cap applies and scales with your credit limit, so large spenders should monitor statements to avoid earning gaps.

Unlocking the Annual Spend Bonus

Reaching £20,000 in card spend within a membership year activates a powerful choice of one of three rewards. The decision hinges on your travel style and upcoming plans.

- Companion Seat Voucher—Use points in Upper Class, Premium, or Economy to book a second seat for a travelling partner. Taxes and fees remain payable.

- Cabin Upgrade Voucher – Apply the voucher to move from Economy Classic to Premium or from Premium to Upper Class on a points booking.

- Virgin Clubhouse Lounge Pass – Enjoy a single-visit pass to Virgin’s flagship lounges when departing on a same-day flight operated by Virgin Atlantic, Delta, Air France, or KLM.

Choose the option that best aligns with your destination list and seat preferences each year.

Virgin Money Cashback

Virgin Money’s in-app cashback hub widens value beyond airline perks, allowing you to recoup a slice of day-to-day spending. Here’s how it works:

- Register for Virgin Money Cashback inside the Virgin Money credit-card app.

- Browse participating brands and activate individual offers before shopping.

- Earn percentage-based rebates that appear as cash in the app.

- Transfer cashback to a UK bank account, your Virgin Atlantic card balance, or swap it for e-Gift vouchers.

Because offers refresh regularly, checking the app before major purchases maximises returns.

Fee Structure, APR, and Other Charges

Understanding costs protects your budget and prevents surprise fees while you accumulate points.

| Cost Component | Amount | Notes |

| Annual fee | £0 | Keeps holding costs minimal. |

| Purchase APR | 22.9 % p.a. variable | Applies after any promotional period. |

| Balance transfer rate | 0 % for six months, then 22.9 % | 3 % handling fee for the first two months, 5 % thereafter. |

| Over-limit fee | £9 | Charged if the statement balance exceeds the credit limit. |

Remember to clear balances monthly to avoid interest and maximise net reward value.

Eligibility Requirements

Meeting baseline criteria speeds approval and safeguards your credit score.

- Age 18 or older.

- Current UK resident with a UK bank or building society account.

- Minimum personal income of £7,000 or household income of £15,000.

- No existing Virgin Atlantic credit card open, and none closed within the previous six months.

- Healthy credit history free from recent bankruptcies or multiple missed payments.

Worldwide travellers based outside the UK should explore local Virgin Atlantic co-branded cards issued via regional partners.

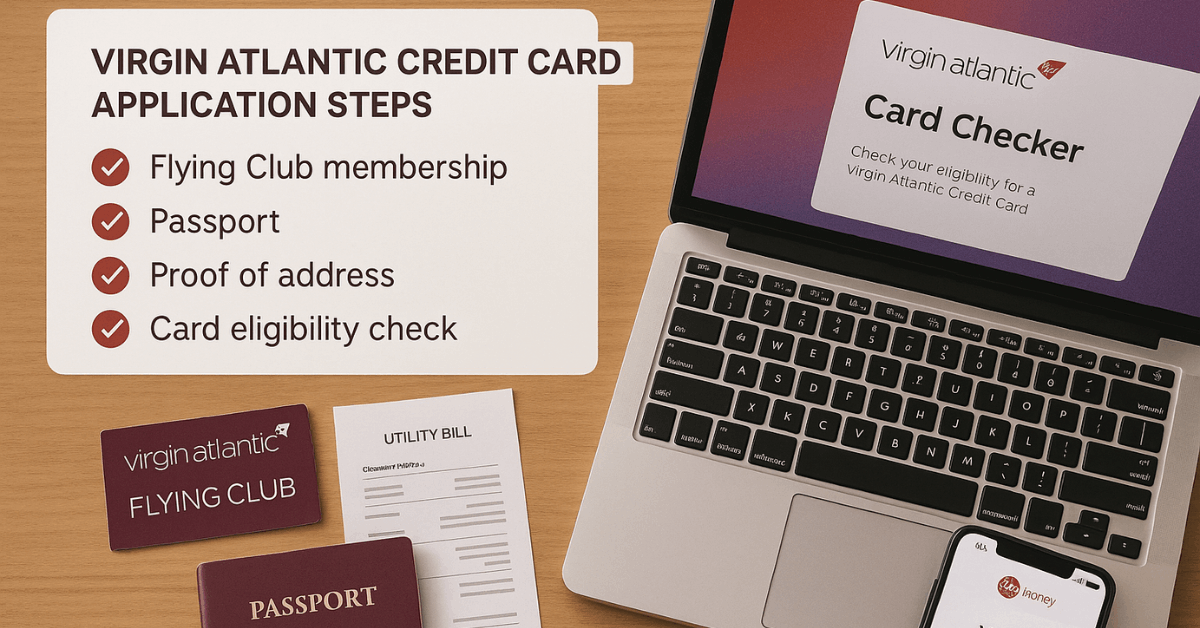

Application Checklist

A structured approach prevents errors that delay approval.

- Check eligibility online. Use Virgin Atlantic’s Card Checker tool; the soft search leaves your credit score untouched.

- Gather documents. Prepare proof of identity, proof of address, bank account details, Flying Club membership number, and information for any planned balance transfers.

- Complete the digital form. Supply personal and financial data accurately.

- Submit and await the decision. Most applicants receive an instant verdict.

- Activate the card on arrival. Download the Virgin Money app to manage statements and enable cashback immediately.

What Happens if the Application Is Declined

A declined application can feel frustrating, yet resolving the issue is straightforward when you follow concrete steps.

- Request a free credit report from a major bureau, then identify errors or negative factors.

- Dispute incorrect information quickly; bureaus must investigate.

- Lower credit-utilisation ratios by reducing existing balances before reapplying.

- Avoid multiple rapid applications; several recent hard enquiries can depress approval odds.

Patience and targeted repairs usually restore eligibility within a few months.

Tips to Maximise Virgin Points in the United Kingdom

Small behavioural tweaks compound value and shorten the journey to free flights.

- Consolidate everyday spending. Funnel grocery, fuel, and utility bills through the card, then pay balances in full.

- Plan high-value redemptions. Long-haul Upper Class seats deliver the best pence-per-point value.

- Monitor partner promotions. Transfer bonuses from hotel programs or buy-points sales can boost balances quickly.

- Leverage household pooling. Combine points with a household member to unlock premium-cabin seats sooner.

Customer-Support Channels

Knowing where to turn for help keeps account maintenance stress-free.

| Region | Phone Number |

| United Kingdom | +44 (0)344 874 7747 |

| United States | +1 800 862 8621 |

Additional country-specific lines appear on the Virgin Atlantic website. Written correspondence can be directed to The VHQ, Fleming Way, Crawley, West Sussex, RH10 9DF.

Disclaimer: Credit products carry risk. Review full terms and conditions carefully and seek independent advice where necessary before applying.

Conclusion

The Virgin Atlantic Reward Credit Card delivers meaningful value for frequent flyers and everyday spenders alike.

Between flexible redemption options, cashback rewards, and no annual fee, it strikes a smart balance between perks and practicality.

If your spending habits align and you meet the eligibility criteria, this card could be a strong addition to your financial toolkit for earning Virgin Points and unlocking travel benefits with ease.